Restaurant leaders today find themselves in a rush to optimize every individual part of their operations while overcoming cost pressures, supply chain challenges, and technology proliferation.

Sadly, the tower of technology tools is stacked so high that managing the entire system has become burdensome (and exhausting). Rather than enabling efficiency, as it was meant to do, technology has become an extraordinary time suck—not to mention extremely expensive.

But there is Hope!

Findings from our recent technology survey make it clear that the restaurant industry is collectively embracing efficiency at a whole new level.

That’s why we’re dubbing 2023 The Year of Efficiency. The industry has reached a turning point. It’s ripe for innovation, consolidation, and unification—all in service to greater efficiencies.

This article is the first of a two-part series distilling the most important findings from the our 4th Annual State of Digital Report. For the most in-depth analysis, download the full report.

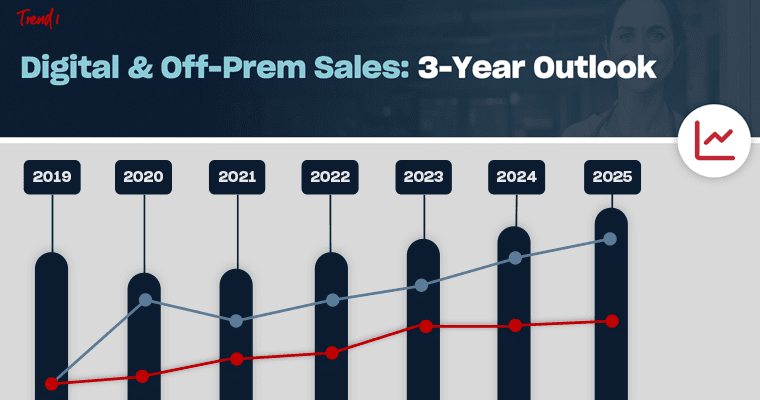

1) More predictable digital sales will enable operational efficiency.

The pandemic triggered an unprecedented demand for off-premises digital ordering, presenting a mix of exciting growth opportunities and technical complications. But between third-party delivery integration headaches, order fulfillment complications, and inconsistent customer experiences across channels, fast casual and quick-service restaurants (QSRs) are now faced with many technology-related inefficiencies.

But there’s good news, too.

Off-premises sales are finally starting to settle into a predictable rhythm. According to our survey findings, QSRs and fast casuals saw digital sales averaging 25% of total sales in 2022. While this statistic indicates a minor cooling off of prior years’ big spikes, digital sales growth will continue to increase, just at a slower rate.

More predictability should translate to more efficiency in the long term. Brands should plan for this more predictable digital sales pattern and adjust operations accordingly.

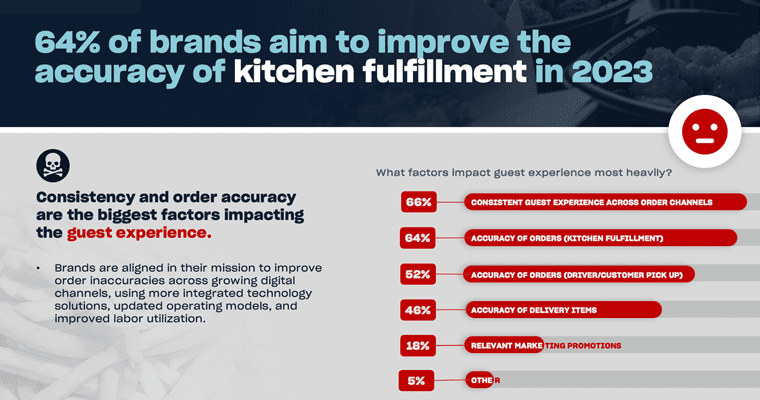

2) Improvement in order accuracy rates will create new efficiencies.

Customers are tired of restaurants getting their orders wrong. They’re thinking, “How hard is it to remember that side of onion rings?” Well, it’s not actually that easy. Thanks to tickets flooding in from a broad spectrum of channels, order accuracy is tougher than ever.

And it’s most problematic in off-premises ordering. Many study respondents reported 15% lower guest satisfaction rates on digital orders than on-premises orders. Order accuracy in kitchen fulfillment was cited as the primary culprit of this dissatisfaction.

But this isn’t your kitchen’s fault.

The problem lies in that towering tech stack and the fact that its components aren’t talking to one another. Non-integrated technology makes juggling orders a nightmare and sets them up for failure. And as a franchise expands locations and individual store traffic grows, order inaccuracy becomes exponentially more difficult to rein in. Ultimately, the guest experience will suffer at every location—and those inaccurate orders will lead to diminishing market shares as competition gets ever more intense.

That’s probably why 50% of brands told us they plan to update to a unified commerce platform within 24 months. Restaurants also recognize they need to switch to more unified fulfillment strategies and technologies with better integrations that smooth communication between kitchen display systems and diverse ordering channels. This shift towards unified ordering systems shows that restaurants are empowering their kitchen staff with a more efficient fulfillment strategy and providing customers a better ordering experience.

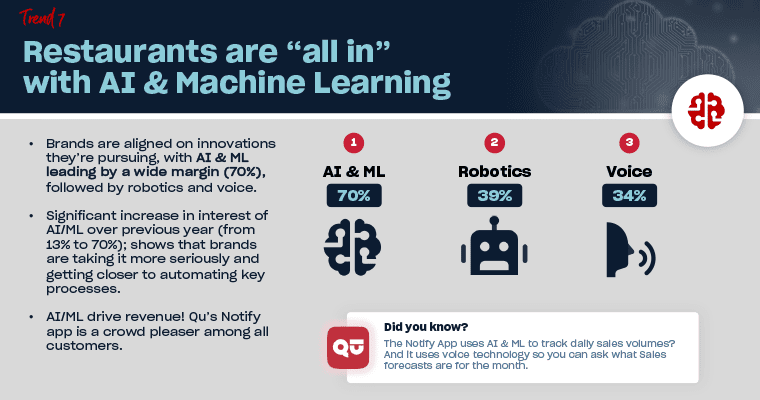

3) AI innovations will translate into front- and back-of-house efficiencies.

Data is the oil that keeps restaurants running smoothly. Improved data analytics empowers companies to make more efficient decisions about every aspect of their business. So it’s no surprise that 70% of restaurants identified AI and machine learning (ML) as their top innovation priorities.

AI and ML improve the efficiency of many operations. They can inform decision-making about menu pricing and offerings across a network of dynamic locations, help narrow the focus of the next big marketing campaign, and deliver data-backed performance insights and forecasts.

Robotics and tech also found their way into the top three innovation priorities. This, too, is unsurprising, as the current labor shortage has placed pressure on operations to perform the most vital functions of restaurant service.

Those who are fearful that these technologies will replace restaurant staff can rest easy. The true value of robotics and voice tech is that they can reduce wait times, improve order accuracy, and free restaurant staff from easily automated tasks. Employees can then use the time they saved to focus on value-adding work such as enhancing guest interaction. These technologies don’t replace workers; they allow workers to work more efficiently and ultimately, creatively and freely.

Related Podcast: AI Inside & Outside the 4 Walls, with Phil Crawford

Related Podcast: AI Inside & Outside the 4 Walls, with Phil Crawford

4) Demand agility from your technology providers to optimize efficiencies.

Restaurants are no longer willing to settle for a run-of-the-mill tech service provider. Our research found they’re looking for a tech company they can trust to be transparent, dependable, and committed to helping their business when it all hits the fan.

They need a partner.

Tech companies that wish to partner with quick-service and fast casual restaurants have to share the brand’s vision. They need to prove themselves willing to remain true to the brand’s goals over personal gain. They should be unafraid to take accountability for their actions and prioritize open, honest communication.

As the complexity of their tech stack increases, restaurants have to deal with multiple providers. It’s hard enough to find one reliable company, let alone a whole team of them you’d trust to have your back. And we haven’t even mentioned the communication juggling act that is now required of chief technology officers (CTOs).

Given this landscape, we predict that restaurant brands will seek out more transparent and customer service-oriented tech companies to partner with. They will gravitate toward companies that can consolidate diverse functions into an easier-to-manage, unified platform.

Closing Thoughts

The findings of our 4th annual study made clear that restaurant brands are approaching more efficient operations through technology unification and consolidation. Keep an eye out for the next article in this series, where we’ll break down The Great Unification happening across the industry and its effect on restaurant technology.

Check out the full report for a deeper look into the state of restaurant tech and the data you need to help your business evolve.

Once again, we’d like to welcome you to 2023, The Year of Efficiency.